CPHI Online is the largest global marketplace in the pharma ingredients industry

-

Products551,744

-

Companies7,781

-

Articles11,636

-

Events8

-

Webinars342

How does it work

CPHI Online is a global marketplace.

The place where global Pharma professionals come to source new partners, look for products and solutions and make connections – all year round. It’s also a go-to place to learn about the latest trends, developments and news in the Pharma industry.

If your company wants to do business with the global Pharma industry, this is the place to be.

Why CPHI Online

CPHI Online is the largest global marketplace where the pharma community comes to source new partners, showcase products and solutions, and make connections.

-

Direct access to your target Pharma audience

-

Effective reporting

-

Multi or single channel campaigns

-

Measurable communications and results

-

Scalable multi-channel campaigns

-

Build brand credibility

-

Generate leads

-

Access to expert analysts

-

Promotional campaign around your content

-

Innovative and memorable content

Trusted by over 7,000 pharma companies, including:

Top Products

CPHI Pharmaceutical Products, Companies and News

News Pharma giants battle over COVID-19 patents in London courts

Two key players in the COVID-19 vaccine story – Pfizer/BioNTech and Moderna – have begun the latest chapter of their global legal battle over patents concerning technology for the development of mRNA therapeutics such as the COVID-19 vaccin...

24 Apr 2024

News Women in Pharma: Diversi‘tea’ at CPHI North America

CPHI North America will unite the pharmaceutical supply chain in Philadelphia from May 7–9, 2024 for 3 days of innovation and connections. As part of the content Agenda, our Diversity Track will bring the industry together to discuss the imperati...

23 Apr 2024

News CPHI Online Webinar Series – Optimising Pharma Manufacturing through Digital Transformations

This month’s CPHI Webinar Series explored achieving manufacturing excellence in pharma through the digitalisation of daily processes. Presented by Joe Doyle, Head of Sales at EviView, and Bikash Chatterjee, President and Chief Scientific Off...

22 Apr 2024

Pharmaceutical Industry Content

Pharmaceutical Industry Webinars

-

Webinar Exploring Three Technological Trends in the Future of Pharmaceutical Manufacturing

-

23rd May 2024

-

4pm CET / 10am EST

-

-

Webinar Achieving Manufacturing Excellence Through Digital Transformation

-

16th April 2024

-

4pm CET / 10am EST

-

-

Webinar Made in Africa: What’s Driving Pharma Manufacturing

-

28th March 2024

-

4pm CET / 10am EST

-

-

Webinar Case Study: Risk Management for Annex 1 Sterile Production EMS

-

28th February 2024

-

4pm CET / 10am EST

-

-

Webinar Innovative Strategies for B2B Pharma Marketeers: Driving Value through Content

-

20th February 2024

-

4pm CET / 10am EST

-

-

Webinar Revolutionizing Pharma: Data and AI Unleashed

-

18th January 2024

-

4pm CET / 10am EST

-

-

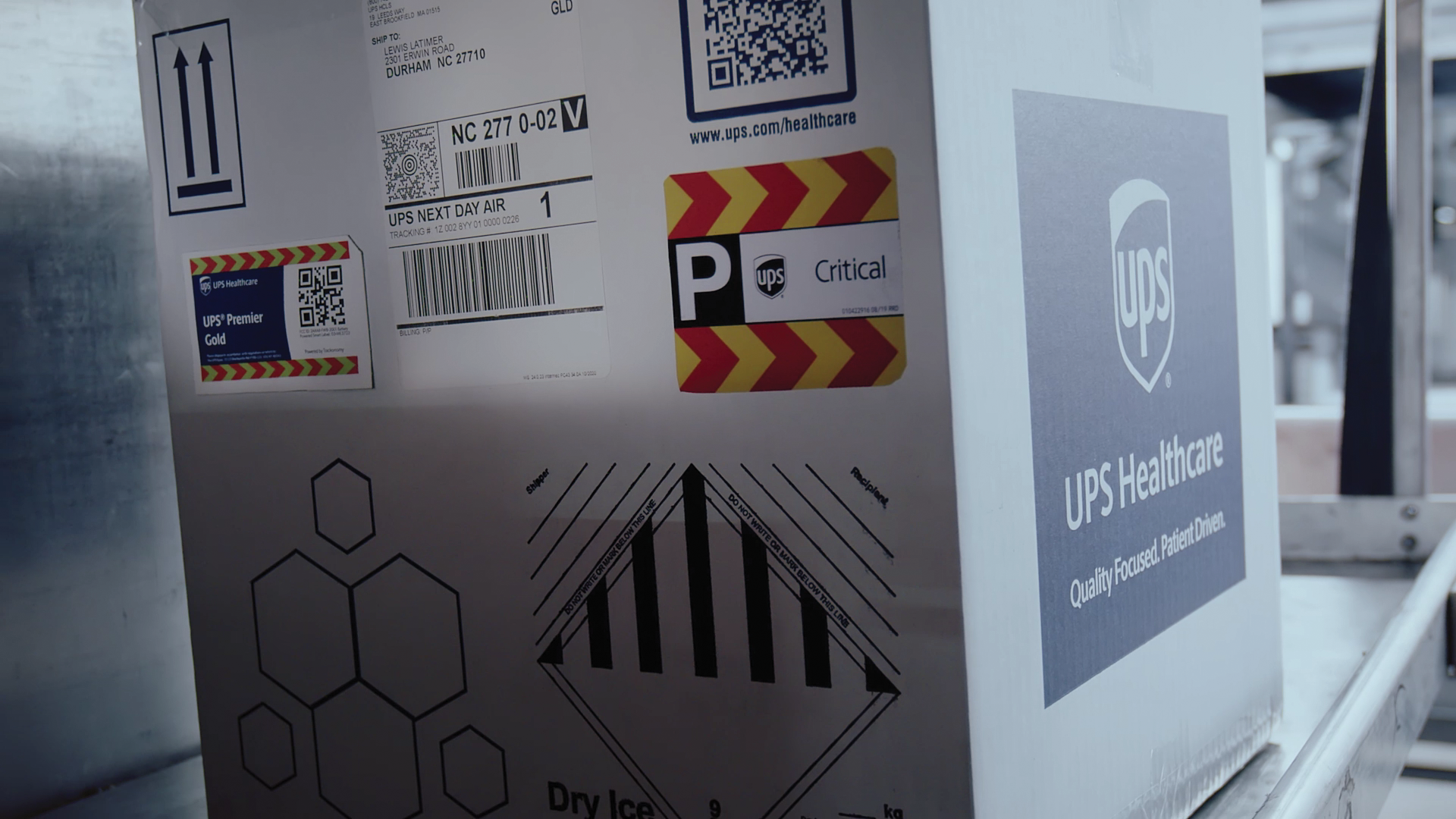

Webinar Optimal Temperature: Elevating Biologics Cold Chain Excellence

-

16th January 2024

-

4pm CET / 10am EST

-

-

Webinar Market Outlook – The Biggest Pharma Trends of 2024

-

12th December 2023

-

4pm CET / 10am EST

-

-

Webinar The Next Frontier – Emerging Opportunities in the LATAM Pharma Market

-

21st November 2023

-

4pm CET / 10am EST

-

-

Webinar Vistamaxx™ MED - imagine the possibilities for healthcare product performance

-

10th October, 2023

-

4pm CET / 10am EST

-

-

Webinar Co-processing: A Multifaceted Approach for Enhancing Density & Powder Flow

-

19th September 2023

-

4pm CET / 10am EST

-

-

Webinar The Outlook for Cell & Gene Therapy Manufacturing

-

28th June 2023

-

4pm CET / 10am EST

-

-

Webinar Contract Packaging Outlook: Growth Trends within the Commercial Packaging Sector

-

25th May 2023

-

4pm CET / 10am EST

-

-

Webinar The HPAPI Boom: How Pharma is Rising to the Manufacturing Challenge

-

23rd February 2023

-

4pm CET / 10am EST

-

Sponsored Pharmaceutical Industry News

-

News The final six: meet the last Start-Ups exhibiting at CPHI NA 2024

The last six Start-Up companies that have made the list to exhibit in a dedicated area in Philadelphia at CPHI North America. Learn more about the companies and what makes them unique in the latest infographic.9 Apr 2024 -

News The Patient-Centric Synergy of Pharmaceutical CDMO and CRO Collaborations

Pharmaceutical collaborations are nothing new to the industry. Increasingly complex drug development programs, calls for supply chain resiliency, and the involvement of all key stakeholders throughout a drug’s development lifecycle are pushing co...4 Oct 2023 -

News Your Global Pharmaceutical Partner: Hangzhou Tomson Biopharma

Introducing TSN Biopharma14 Sep 2023 -

News Asymchem is Positioned to be the CDMO of the Future

Why Asymchem is your most reliable CDMO partner12 Sep 2023 -

News High demand: Vetter expands production capacities and services offered at its Austrian site

Pharma service provider further expands offerings for clinical development and manufacturing9 Jun 2023

.jpg)

.png)

.png)

.png)

-comp316140.jpg)

.png)

.png)

.jpg)

.png)